Keller Group plc, the world’s largest geotechnical specialist contractor, announces its results for the half year ended 30 June 2024.

Outstanding H1 performance; expectations for FY 2024 materially increased

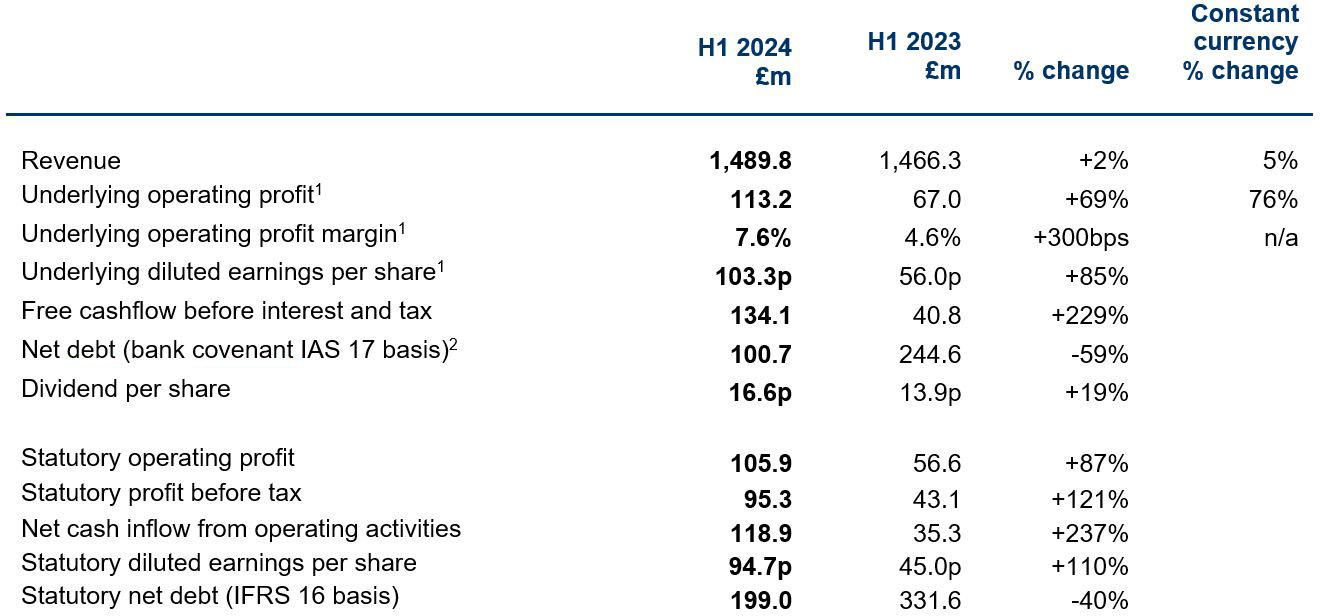

1 Underlying operating profit and underlying diluted earnings per share are non-statutory measures which provide readers of this Announcement with a balanced and comparable view of the Group’s performance by excluding the impact of non-underlying items, as disclosed in note 7 to the interim condensed consolidated financial statements.

2 Net debt is presented on a lender covenant basis excluding the impact of IFRS 16 as disclosed within the adjusted performance measures in the interim condensed consolidated financial statements.

Highlights

- Outstanding first half performance sets new records across the Group as we continued to sustain and build on the material step-up in operational and financial performance delivered in 2023

- Revenue of £1,489.8m, up 5% at constant currency

- Underlying operating profit of £113.2m, up 76% at constant currency

- Underlying operating profit margin increased by 300bps to 7.6% (H1 2023: 4.6%)

- Underlying diluted EPS of 103.3p, up 85%

- Underlying ROCE at 28.4% (H1 2023: 16.6%), the highest for 15 years

- Net debt2 of £100.7m, down £46m since December 2023, driven by strong profitability and cash generation, with net debt/EBITDA leverage ratio2 of 0.3x (H1 2023: 1.2x; FY 2023: 0.6x)

- Statutory operating profit up 87% to £105.9m

- Statutory diluted EPS of 94.7p, up 110%

- Board’s expectations for full year 2024 materially increased, underpinned by our record order book of £1.6bn

- Our Accident Frequency Rate remained unchanged at 0.09 with nine lost time events

- The interim dividend has been rebased to 16.6p (H1 2023: 13.9p), following the 20% increase in the 2023 full year dividend; anticipating a 2024 full year dividend increase of 5%

The current macroeconomic environment presents opportunities, particularly in North America, albeit there are challenges in some of our other markets. The strength of the Group’s performance, together with the quality of our record £1.6bn order book, provides us with increased confidence in the outlook for the rest of this year. As a consequence, the Board now anticipates that the Group’s performance for the full year will be materially ahead of current market expectations1. This performance will have a modest weighting towards the first half given beneficial tailwinds in the period.

1 Analyst consensus underlying operating profit for FY 2024: £178m; range: £176m – £179m.

For further information, please contact:

Keller Group plc

Michael Speakman, Chief Executive Officer

David Burke, Chief Financial Officer

Caroline Crampton, Group Head of Investor Relations

www.keller.com

020 7616 7575

FTI Consulting

Nick Hasell

Matthew O’Keeffe

020 3727 1340

A webcast and presentation for investors and analysts will be held at 08.30am BST on 6 August 2024, at, Storey Club, 100 Liverpool Street, London EC2M 2AU.

RSVP: [email protected]

The webcast replay will be available later the same day on demand:

https://connectstudio-portal.world-television.com/6633a65ec13aef73fe277e1c/registration

Conference call:

UK (Local): 020 3936 2999

UK (Toll-Free): 0800 358 1035

Participant access code: 184466

Notes to editors:

Keller is the world's largest geotechnical specialist contractor providing a wide portfolio of advanced foundation and ground improvement techniques used across the entire construction sector. With around 9,500 staff and operations across five continents, Keller tackles an unrivalled 5,500 projects every year, generating annual revenue of c.£3bn.

Cautionary statements:

This document contains certain 'forward-looking statements' with respect to Keller's financial condition, results of operations and business and certain of Keller's plans and objectives with respect to these items. Forward-looking statements are sometimes, but not always, identified by their use of a date in the future or such words as 'anticipates', 'aims', 'due', 'could', 'may', 'should', 'expects', 'believes', 'intends', 'plans', 'potential', 'reasonably possible', 'targets', 'goal' or 'estimates'. By their very nature, forward-looking statements are inherently unpredictable, speculative and involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. These factors include, but are not limited to, changes in the economies and markets in which the Group operates; changes in the regulatory and competition frameworks in which the Group operates; the impact of legal or other proceedings against or which affect the Group; and changes in interest and exchange rates. For a more detailed description of these risks, uncertainties and other factors, please see the Principal risks and uncertainties section of the Strategic report in the Annual Report and Accounts. All written or verbal forward-looking statements, made in this document or made subsequently, which are attributable to Keller or any other member of the Group, or persons acting on their behalf, are expressly qualified in their entirety by the factors referred to above. Keller does not intend to update these forward-looking statements. Nothing in this document should be regarded as a profits forecast. This document is not an offer to sell, exchange or transfer any securities of Keller Group plc or any of its subsidiaries and is not soliciting an offer to purchase, exchange or transfer such securities in any jurisdiction. Securities may not be offered, sold or transferred in the United States absent registration or an applicable exemption from the registration requirements of the US Securities Act of 1933 (as amended).

LEI number: 549300QO4MBL43UHSN10. Classification: 1.2 (Half yearly financial reports).