Keller Group plc, the world’s largest geotechnical specialist contractor, announces its results for the half year ended 26 June 2022.

Record profit in H1, confidence in H2 outlook maintained and dividend increased

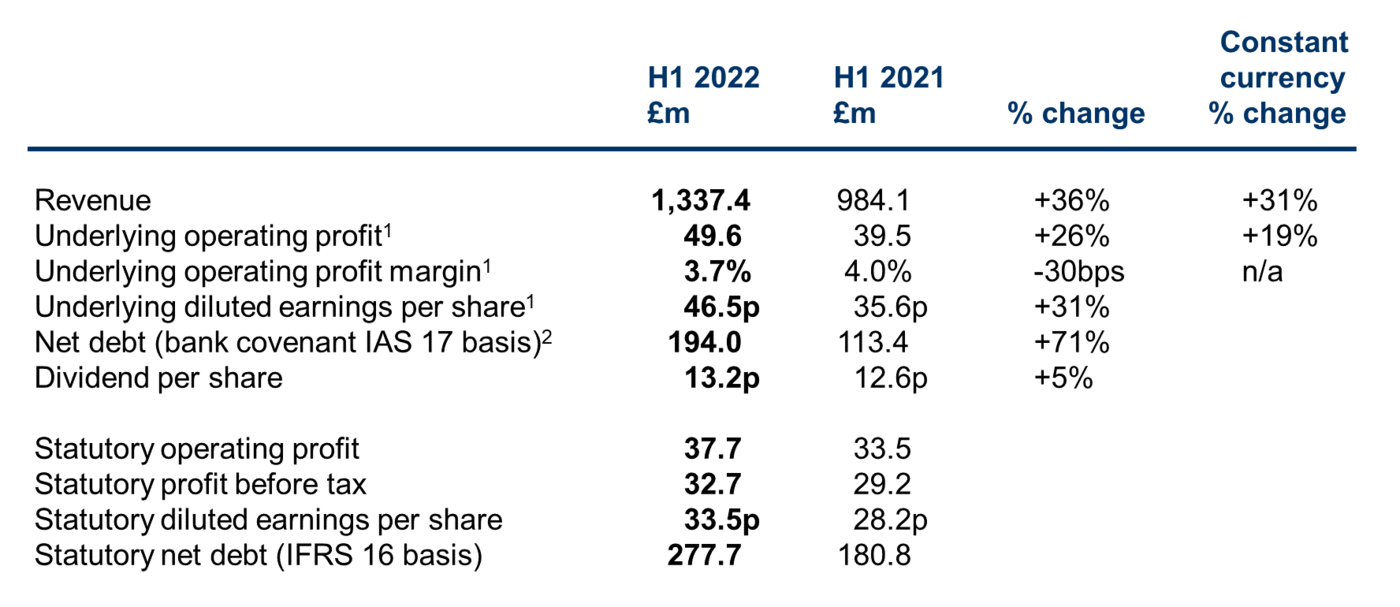

1 Underlying operating profit and underlying diluted earnings per share are non-statutory measures which provide readers of this Announcement with a balanced and comparable view of the Group’s performance by excluding the impact of non-underlying items, as disclosed in note 7 of the interim condensed consolidated financial statements.

2 Net debt is presented on a lender covenant basis excluding the impact of IFRS 16 as disclosed within the adjusted performance measures in the interim condensed consolidated financial statements.

Highlights

- Record first half performance despite the current macroeconomic challenges

- Revenue of £1,337.4m, up 31% on a constant currency basis, reflecting growth in all three divisions as trading activity recovered following the impacts of COVID-19

- Record first half underlying operating profit of £49.6m, up 19% on a constant currency basis, driven by growth and the active management of inflationary pressures and materials and labour availability

- Group operating margin of 3.7% reflects the passing on of materials cost inflation with little or no mark-up and some operational challenges in the North America Foundations business

- Net debt (on a bank covenant IAS 17 basis) of £194.0m, equating to a net debt/EBITDA leverage ratio of 1.1x (H1 2021: 0.7x), well within our target range of 0.5x – 1.5x

- Mobilising in preparation for work on major new contract to undertake work on the prestigious NEOM project in Saudi Arabia where we are well positioned, with the potential to generate contract revenues in the hundreds of millions of pounds in future years

- A number of recent contract awards and prospects in the energy and infrastructure sectors, including increased LNG activity where Keller has both a well-established presence and an excellent reputation

- ESG: On climate action, we are making good progress towards our net zero targets with specific actions taken at business unit level in collaboration with industry partners

- The overall accident frequency rate increased slightly to 0.09 from 0.08 injuries per 100,000 hours worked, driven by a small number of lost time injuries in Europe. North America and AMEA continued to show improvement, with zero injuries reported in AMEA

- Continued successful strategy execution, with a bolt-on acquisition in North America and restructuring of specific business units in Europe and AMEA

- Interim dividend increased by 5% to 13.2p, continuing the dividend policy of long-term progression, and building on the Group’s uninterrupted record of maintaining or increasing the dividend since flotation in 1994. The Board is also reviewing a further increase to the final dividend

Outlook

- Record order book of £1.6bn at the end of June, up 31% on the prior period, and up 22% on a constant currency basis, underpinning future performance

- The Board’s expectations for the Group’s full-year performance remain unchanged, with our usual increase in trading momentum and moderate second half weighting

For further information, please contact:

Keller Group plc

Michael Speakman, Chief Executive Officer

David Burke, Chief Financial Officer

Caroline Crampton, Group Head of Investor Relations

www.keller.com

020 7616 7575

FTI Consulting

Nick Hasell

Matthew O’Keeffe

020 3727 1340

A webcast for investors and analysts will be held at 09.00am BST on 2 August 2022 and will also be available later the same day on demand: https://www.investis-live.com/keller/62d1570959bc74140084098a/ebppos