Keller Group plc (‘Keller’ or ‘the Group’), the world’s largest geotechnical specialist contractor, announces its results for the half year ended 27 June 2021.

A better than expected performance in H1; strong momentum building into H2

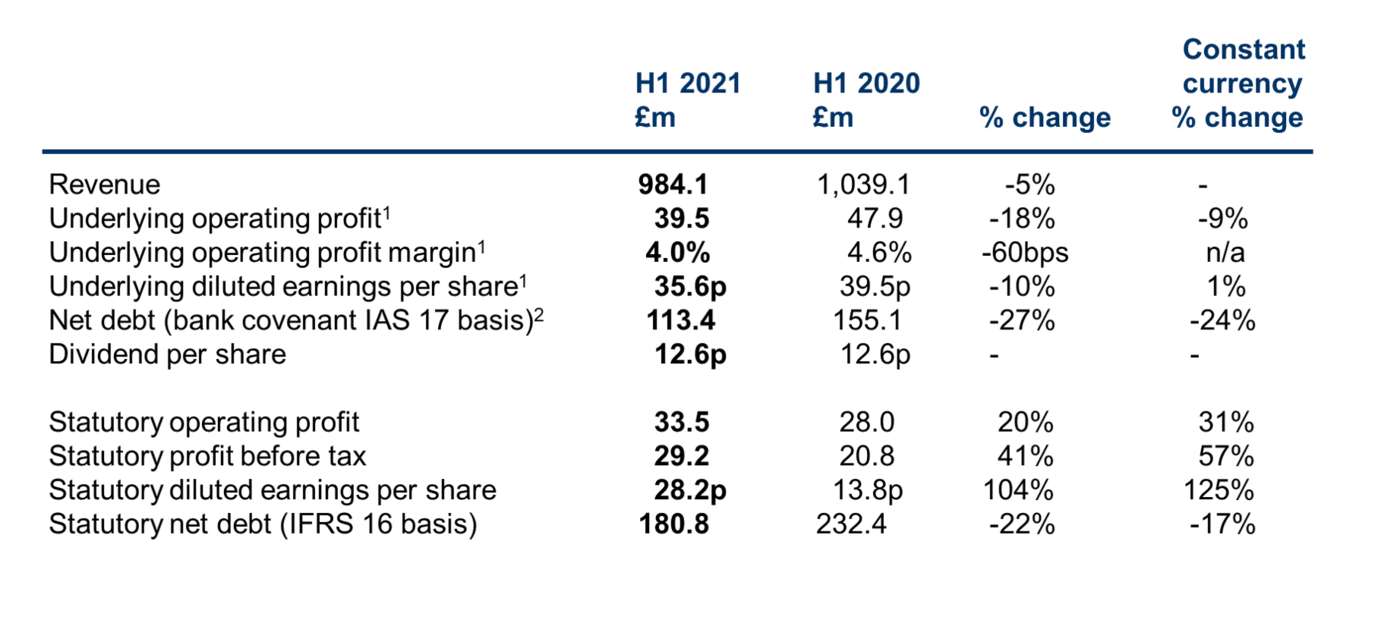

1 Underlying operating profit and underlying diluted earnings per share are non-statutory measures which provide readers of this Announcement with a balanced and comparable view of the Group’s performance by excluding the impact of non-underlying items, as disclosed in note 7 of the interim condensed consolidated financial statements.

2 Net debt is presented on a lender covenant basis excluding the impact of IFRS 16 as disclosed within the adjusted performance measures in the interim condensed consolidated financial statements.

Highlights

- A better than expected first half trading performance, despite the anticipated market-driven compression in contract margins as a result of COVID-19 and headwinds from foreign exchange

- Revenue of £984.1m was flat on a constant currency basis, with a slow Q1 followed by improved momentum in Q2

- Underlying operating profit decreased 9% to £39.5m, on a constant currency basis, after adjusting for a foreign exchange headwind of c£5m. The positive resolution of a historical claim in North America was more than offset by the anticipated impact of COVID-19, higher steel prices in the Suncoast business and unrecognised revenue on suspended contracts in Africa, predominantly a liquefied natural gas (LNG) contract in Mozambique

- Net debt (on a bank covenant IAS 17 basis) reduced by 27% to £113.4m, equating to net debt/EBITDA leverage ratio of 0.7x (H1 2020: 0.9x) driven by continued strong cash performance

- Further progress in operational safety evidenced by a 27% improvement in our overall accident frequency rate

- ESG: On climate action, one of the Group’s 4 specific UN Sustainable Development Goals, we have now set ambitious net zero targets for all three of our emission scopes which will culminate in carbon neutrality by 2050 at the latest

- Execution of our strategy continued with the completion of restructuring actions in Europe and the acquisition of RECON Services, Inc in North America in July

- Maintained dividend of 12.6p, continuing the Group’s uninterrupted record of maintaining or increasing the dividend since flotation in 1994

Outlook

- Our order book at the end of June up 11% to £1.2bn on the prior period and on a constant currency basis. A record high, reflecting the recovery of economic activity across our markets, particularly in North America and Europe

- The Group’s performance for the full year is now anticipated to be materially ahead of the Board’s previous expectations, with a modest second half bias

For further information, please contact:

Keller Group plc

Michael Speakman, Chief Executive Officer

David Burke, Chief Financial Officer

Caroline Crampton, Group Head of Investor Relations

www.keller.com

020 7616 7575

FTI Consulting

Nick Hasell

Matthew O’Keeffe

020 3727 1340

A webcast for investors and analysts will be held at 08.30am BST on 3 August 2021 and will also be available later the same day on demand

https://www.investis-live.com/keller/60eecc362527a916004f0c6a/hyr21