Keller Group plc (‘Keller’ or ‘the Group’), the world’s largest geotechnical specialist contractor, announces its results for the year ended 31 December 2022.

Record revenue, strong underlying profit growth and dividend increased

1 Restated for prior period accounting error arising from the financial reporting fraud at Austral and prior period business combination measurement adjustments as detailed in notes 3 and 6 to the consolidated financial statements

2 Underlying operating profit, underlying profit before tax and underlying diluted earnings per share are non-statutory measures which provide readers of this announcement

with a balanced and comparable view of the Group’s performance by excluding the impact of non-underlying items, as disclosed in note 9 of the consolidated financial statements

3 Net debt is presented on a lender covenant basis excluding the impact of IFRS 16 as disclosed within the adjusted performance measures in the consolidated financial statements

Highlights

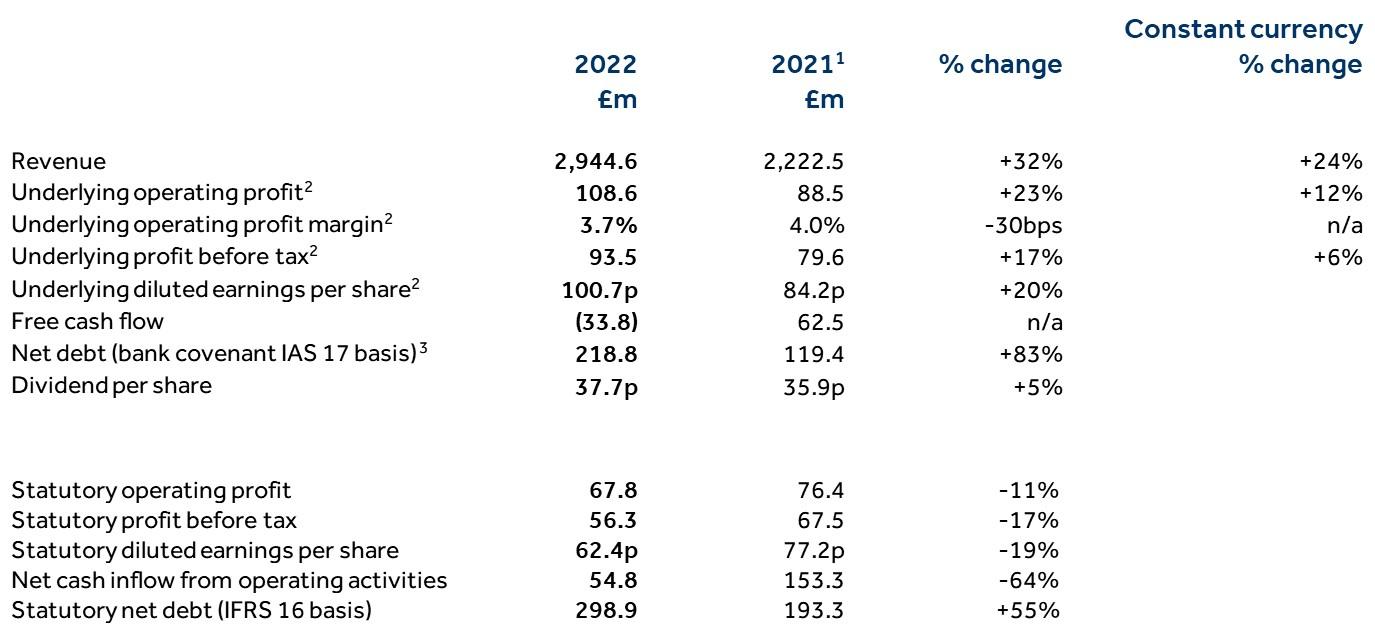

- Revenue increased to a record £2,944.6m, up 32%, comprised organic growth of 22%, acquisition growth of 2% and an FX tailwind of 8%

- Underlying operating profit increased to £108.6m, up 12% (at constant currency) as a result of continued strategic and operational delivery in a turbulent, challenging market environment, and despite events at Austral

- Whilst North American margins recovered in H2 as expected, Group operating margin reduced in the year to 3.7% largely driven by the impact of inflationary cost pressures, supply chain challenges and operational issues in North America Foundations in H1. We expect that the actions we have taken will continue to restore Group margins in 2023

- No material change from the position we announced in January 2023 with respect to a financial reporting fraud at Austral. An external forensic investigation has now confirmed that there has been no cash leakage. The impact on the Group’s historically stated operating profits was c£7.3m in H1 2022, £4.3m in 2021 and £6.7m in the years prior to 2021

- A robust year-end order book at £1.4bn; up 8% (broadly unchanged at constant currency)

- NEOM project in Saudi Arabia is progressing in line with our expectations operationally and financially; piling on the c£40m initial Works Order was completed in February 2023, ahead of schedule and we are in advanced discussions on the next tranche of work. The precise phasing of this potentially material project is fluid and will require measured investment in equipment and working capital as it accelerates

- Underlying EPS of 100.7p, up 20%, driven by higher operating profit and a reduction in the effective tax rate partially offset by increased finance costs

- Statutory profit before tax decreased by 17% to £56.3m, as a result of increased non-underlying costs of £37.2m, comprising £24.0m of non-cash goodwill impairments and amortisation of acquired intangible assets and £13.2m of cash items including the ERP implementation costs of £6.3m and restructuring costs of £5.3m

- Free cash outflow of £33.8m (2021: £62.5m inflow) driven by a £110.5m (2021: £1.2m inflow) increase in working capital, largely driven by 22% increase in organic revenue, supplier behaviour mainly in NA, and an inventory surplus at Suncoast

- Net debt (on a bank covenant IAS 17 basis) of £218.8m, increased by £99.4m, equating to net debt/EBITDA everage ratio of 1.2x (2021: 0.8x), well within the Group’s leverage target of 0.5x-1.5x and the covenant limit of 3.0x. As a consequence of the anticipated investment in NEOM, we expect to remain in the upper end of our target range

- A slight decline in Group safety performance with an increase in finger injuries; overall accident frequency rate increased to 0.10, representing 26 lost time injuries across our c10,000 employees

- The short, medium and long-term actions required to achieve Net Zero emissions by 2050 are in progress. We are ahead of our Scope 2 carbon reduction target of 10%, achieving 28% reduction from our 2019 baseline

- Further successful execution of strategy, with continued portfolio rationalisation and two bolt-on acquisitions that build our share in our chosen markets

- Recommended final dividend of 24.5p, brings the total dividend for the year to 37.7p (2021: 35.9p) an increase of 5%. The increased dividend continues the Group’s uninterrupted track record of increasing or maintaining dividends every year for 28 years and reflects the financial strength of the Group and our confidence in the future

Unaudited Preliminary Results announcement for year ended 31 December 2022

For further information, please contact:

Keller Group plc

Michael Speakman, Chief Executive Officer

David Burke, Chief Financial Officer

Caroline Crampton, Group Head of Investor Relations

www.keller.com

020 7616 7575

FTI Consulting

Nick Hasell

Matthew O’Keeffe

020 3727 1340

A webcast for investors and analysts will be held at 09.00 GMT on 7 March 2023 and will also be available later the same day on demand

https://www.investis-live.com/keller/63da8f583e92bb0c00491950/ksd